Unveiling the Benefits of Digilife Insurance Comparison

Exploring the realm of digilife insurance comparison opens up a world of possibilities for individuals seeking the best coverage options tailored to their needs. From the convenience of online tools to the nuances of policy details, this topic delves into the intricacies of making informed decisions in the digital age.

As we journey through the various aspects of digilife insurance comparison, a clearer picture emerges of how these tools revolutionize the way we approach insurance choices.

Introduction to Digilife Insurance Comparison

Digilife insurance comparison is a platform that allows individuals to compare various insurance options efficiently and conveniently online. It provides a comprehensive overview of different insurance policies available in the market, helping users make informed decisions based on their specific needs and preferences.

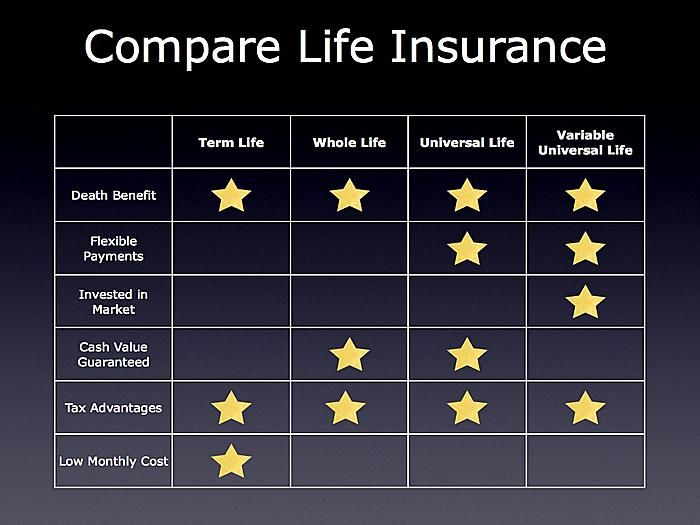

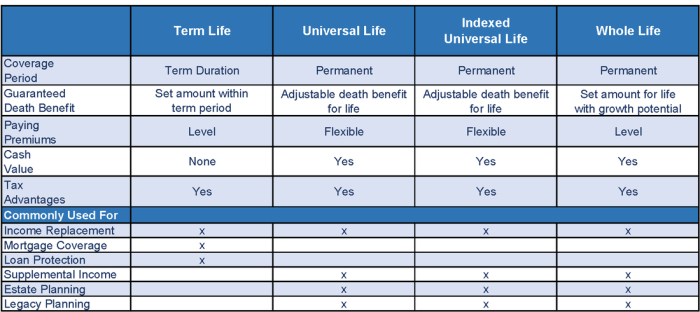

Comparing digilife insurance options is crucial because it enables individuals to find the most suitable coverage at the best possible rates. By evaluating multiple insurance plans side by side, users can identify the features, benefits, and costs that align with their requirements, ensuring they choose a policy that provides adequate protection without overspending.

How Digilife Insurance Comparison Differs from Traditional Insurance Comparison

Unlike traditional insurance comparison methods that involve visiting multiple insurance agents or companies in person, digilife insurance comparison streamlines the process by offering a centralized platform where users can access a wide range of insurance products from different providers. This digital approach saves time, eliminates the need for face-to-face meetings, and allows individuals to compare insurance options from the comfort of their homes.

Benefits of Using Digilife Insurance Comparison Tools

When it comes to choosing the right insurance policy, utilizing Digilife Insurance Comparison Tools can offer several benefits to users.

Efficiency and Convenience

- Online tools allow users to compare multiple insurance options from the comfort of their own home, saving time and effort.

- Users can easily access a wide range of insurance providers and policies in one place, streamlining the comparison process.

Transparency and Clarity

- Digilife Insurance Comparison Tools provide straightforward and easy-to-understand comparisons of coverage, premiums, and benefits.

- Users can view all the relevant information in a clear format, making it easier to make informed decisions.

Cost Savings

- By comparing different insurance plans side by side, users can identify cost-effective options that meet their coverage needs.

- Users can take advantage of competitive pricing and special offers that may be available through the comparison tools.

Factors to Consider When Comparing Digilife Insurance

When comparing Digilife insurance policies, it is essential to consider various factors that can significantly impact your coverage and financial security. Understanding the key aspects of coverage, premiums, deductibles, and exclusions will help you make an informed decision that meets your specific needs and budget.

Coverage

Coverage is one of the most critical factors to consider when comparing Digilife insurance policies. It refers to the extent of protection provided by the policy, including what events or risks are covered. Different policies may offer varying levels of coverage, so it is essential to carefully review the terms and conditions to ensure that the policy meets your requirements

Premiums

Premiums are the amount you pay for the insurance policy, usually on a monthly or annual basis. When comparing Digilife insurance policies, it is crucial to consider the premiums and how they fit into your budget. While lower premiums may seem attractive, they may also indicate limited coverage or higher deductibles, so it is essential to strike a balance between affordability and adequate protection.

Deductibles

Deductibles are the amount you are required to pay out of pocket before your insurance coverage kicks in. When comparing Digilife insurance policies, be sure to consider the deductibles associated with each policy. A policy with a lower deductible may have higher premiums, while a policy with a higher deductible may have lower premiums.

Understanding your financial situation and risk tolerance will help you choose the right deductible for your needs.

Exclusions

Exclusions are specific events or circumstances that are not covered by the insurance policy. It is essential to carefully review the exclusions of Digilife insurance policies to understand what risks are not protected. Some policies may have more extensive exclusions than others, so it is crucial to ensure that the policy aligns with your needs and provides comprehensive coverage.By considering these key factors when comparing Digilife insurance policies, you can make an informed decision that provides you with the right level of coverage and financial protection.

Tips for Choosing the Right Digilife Insurance through Comparison

When comparing digilife insurance options, it's essential to make an informed decision to ensure you get the right coverage for your needs. Here are some tips to help you choose the most suitable digilife insurance through comparison:

Understanding Policy Details and Fine Print

Before selecting a digilife insurance policy based on comparison, it is crucial to carefully read and understand the policy details and fine print. Pay close attention to coverage limits, exclusions, deductibles, and any additional benefits or riders offered. This will help you make an informed decision and avoid any surprises when you need to file a claim.

Balance Cost and Coverage

While it may be tempting to choose the cheapest digilife insurance option, it's important to strike a balance between cost and coverage. Consider your budget, but also think about the level of protection you need. Opting for a slightly higher premium for better coverage may ultimately save you money in the long run by providing adequate financial protection in case of an unexpected event.

Wrap-Up

In conclusion, delving into digilife insurance comparison unveils a landscape of opportunities for individuals to navigate the complexities of insurance options with ease and confidence. By harnessing the power of comparison tools, users can make well-informed decisions that align with their unique needs and preferences.

Frequently Asked Questions

What sets digilife insurance comparison apart from traditional methods?

Digilife insurance comparison offers the convenience of online tools, simplifying the process and providing a more user-friendly experience compared to traditional methods.

How do coverage, premiums, deductibles, and exclusions play a role in digilife insurance comparison?

These factors are crucial when comparing digilife insurance policies as they directly impact the level of protection, costs, and limitations associated with each option.

What tips can help in choosing the right digilife insurance through comparison?

Effective use of comparison tools, understanding policy details, and striking a balance between cost and coverage are key tips to consider when selecting the most suitable digilife insurance.