An informative title that includes the keyword digilife personal finance software

Exploring the realm of personal finance has never been easier with Digilife personal finance software. Dive into a world of financial management where budgeting, expense tracking, and goal setting are seamlessly integrated to provide users with a comprehensive solution.

Detailing the key features, benefits, user experience, and security measures of Digilife, this guide aims to shed light on how this software stands out in the market and caters to a diverse audience of financial enthusiasts.

Overview of Digilife Personal Finance Software

Digilife personal finance software is a comprehensive tool designed to help individuals manage their finances effectively. It offers a range of key features that set it apart from other personal finance software available in the market.

Key Features of Digilife Personal Finance Software:

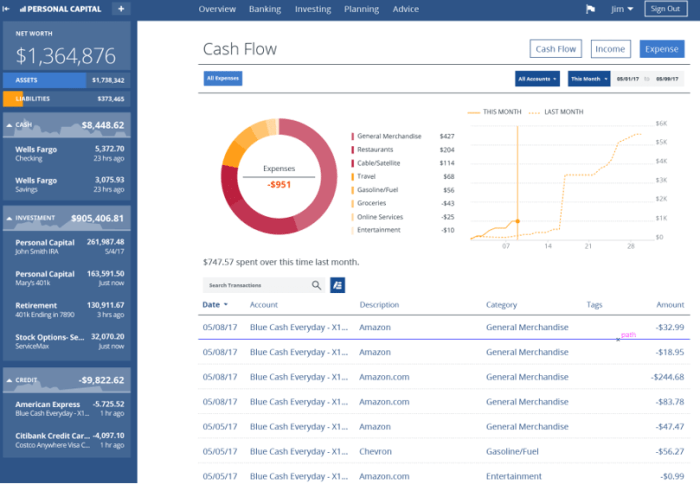

- Expense Tracking: Digilife allows users to track their expenses easily, categorize them, and analyze spending patterns.

- Budgeting Tools: The software provides budgeting tools to help users set financial goals and stay on track.

- Bill Management: Users can manage their bills and receive reminders to avoid missing payments.

- Investment Tracking: Digilife enables users to track their investments and monitor portfolio performance.

- Financial Goal Setting: Users can set and track financial goals to work towards achieving them.

How Digilife Stands Out:

Digilife stands out from other personal finance software due to its user-friendly interface, robust features, and customizable options. It offers a seamless experience for users to manage all aspects of their finances in one place.

Target Audience for Digilife Personal Finance Software:

The target audience for Digilife personal finance software includes individuals looking to take control of their finances, manage expenses effectively, set and achieve financial goals, and track investments. It caters to users of all levels of financial expertise, from beginners to seasoned investors.

Benefits of Using Digilife Personal Finance Software

Managing personal finances can be a challenging task, but with Digilife Personal Finance Software, users can enjoy a multitude of benefits that simplify the process and help them achieve their financial goals.

Efficient Budgeting and Expense Tracking

One of the key advantages of using Digilife is its ability to streamline budgeting and expense tracking. Users can easily create budgets, categorize expenses, and monitor their spending habits in real-time. This feature helps individuals stay on top of their financial obligations and identify areas where they can cut back on unnecessary expenses.

Enhanced Financial Planning

Digilife empowers users to take control of their financial future by providing tools for comprehensive financial planning. With features like goal setting, investment tracking, and retirement planning, individuals can create a roadmap to achieve their long-term financial objectives. This proactive approach to financial planning can help users make informed decisions and secure their financial well-being

User Experience with Digilife Personal Finance Software

Overall, users have provided positive reviews and testimonials about their experience using Digilife Personal Finance Software. Many have praised the software for its user-friendly interface, robust features, and ease of use in managing personal finances effectively.

Navigation and User Interface

The navigation within Digilife Personal Finance Software is intuitive and user-friendly, allowing users to easily access various features and tools without feeling overwhelmed. The interface is well-designed, with clear menus and options that make it simple to input and track financial data.

Users appreciate the visually appealing layout that enhances the overall user experience.

Mobile App vs. Desktop Version

The mobile app version of Digilife Personal Finance Software offers users the convenience of managing their finances on the go. Users can easily track expenses, set budgets, and monitor financial goals from their smartphones or tablets. The app is optimized for mobile use, providing a seamless experience that is comparable to the desktop version.When compared to the desktop version, the mobile app may have slightly limited functionalities due to screen size constraints.

However, users find that the app still offers a comprehensive set of features that meet their financial management needs. The synchronization between the mobile app and desktop version ensures that users can seamlessly switch between devices without losing any data.Overall, users find that the experience with Digilife Personal Finance Software is efficient, effective, and user-friendly, whether using the mobile app or desktop version.

Security and Privacy Features of Digilife Personal Finance Software

When it comes to managing personal finances, security and privacy are of utmost importance. Digilife Personal Finance Software takes these concerns seriously and has implemented various measures to safeguard user data.Digilife ensures the privacy of sensitive financial information by employing robust encryption methods to protect data both at rest and in transit.

This means that your financial data is securely stored and transmitted, preventing unauthorized access.

Encryption and Authentication Methods

- Digilife uses AES 256-bit encryption to secure user data, which is considered one of the most secure encryption standards available.

- Multi-factor authentication is also employed by Digilife to add an extra layer of security, requiring users to verify their identity through multiple steps.

- Secure socket layer (SSL) technology is utilized to encrypt data in transit, ensuring that any information exchanged between your device and Digilife's servers is protected from interception.

Final Review

In conclusion, Digilife personal finance software offers a holistic approach to managing one's finances, empowering users to take control of their financial future with confidence and ease. Whether you're a budgeting beginner or a seasoned investor, Digilife has something to offer for everyone's financial journey.

Query Resolution

How does Digilife personal finance software differ from other options on the market?

Digilife sets itself apart through its user-friendly interface, comprehensive features for budgeting and expense tracking, and robust security measures.

Is Digilife suitable for beginners in financial management?

Absolutely! Digilife caters to users of all experience levels, providing easy-to-use tools and resources for effective financial planning.

Can Digilife be accessed on mobile devices?

Yes, Digilife offers a mobile app that complements the desktop version, allowing users to manage their finances on-the-go.